Life-Changing Financial Tips Everyone Should Know

5 out of 5

| Language | : | English |

| File size | : | 529 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 19 pages |

| Lending | : | Enabled |

Financial knowledge is essential for navigating the complexities of现代生活. Whether you're just starting out or approaching retirement, it's never too late or too early to adopt these life-changing financial tips:

Budgeting: The Foundation of Financial Success

A budget is a roadmap for your finances. It helps you track your income and expenses, identify areas where you can save, and stay on top of your financial goals. Here's how to create a budget:

- Track your income and expenses: Use a budgeting app or spreadsheet to monitor your sources of income and every dollar you spend.

- Categorize your expenses: Divide your expenses into categories such as housing, food, transportation, and entertainment.

- Set financial goals: Determine what you want to save for, such as a down payment on a house or retirement.

- Allocate your funds: Based on your income and expenses,分配资金for each category and your financial goals.

- Review and adjust: Regularly review your budget and make adjustments as needed to stay on track.

Saving: The Key to Financial Security

Saving money is crucial for unexpected expenses, financial emergencies, and long-term goals. Here are some tips:

- Set savings goals: Determine specific savings targets, such as an emergency fund or retirement savings.

- Automate savings: Set up automatic transfers from your checking to savings account on a regular basis.

- Use high-yield savings accounts: Choose savings accounts that offer higher interest rates to maximize your returns.

- Make saving a habit: Treat saving as a non-negotiable expense and prioritize it in your budget.

- Avoid unnecessary spending: Track your expenses and identify areas where you can cut back or negotiate lower costs.

Investing: Growing Your Wealth

Investing allows you to grow your money over time and achieve financial independence. Here's how to get started:

- Educate yourself: Learn about different investment options, such as stocks, bonds, and mutual funds.

- Diversify your portfolio: Spread your investments across different asset classes and sectors to reduce risk.

- Start small: Begin investing with an amount you can afford to lose and gradually increase your contributions over time.

- Invest for the long term: Don't get discouraged by short-term market fluctuations. Focus on staying invested for the long haul.

- Seek professional advice: Consider consulting a financial advisor if you need personalized guidance.

Debt Management: Breaking Free from Financial Stress

Managing debt effectively is essential for financial freedom. Here's how:

- Consolidate high-interest debt: Transfer multiple high-interest debts to a lower-interest loan or balance transfer credit card.

- Negotiate with creditors: Contact your creditors and explore options to reduce interest rates or payment amounts.

- Prioritize paying off debt: Focus on paying off high-interest debts first, such as credit card balances or payday loans.

- Avoid unnecessary debt: Only borrow money when absolutely necessary and for responsible reasons.

- Build an emergency fund: Having an emergency fund can help prevent you from resorting to debt in unexpected situations.

Credit Score: Protecting Your Financial Reputation

Your credit score is a numerical representation of your creditworthiness. Here's how to maintain and improve your credit score:

- Pay your bills on time: Payment history is the most significant factor in your credit score.

- Keep your credit utilization low: Use less than 30% of your available credit on each credit card.

- Limit new credit applications: Avoid applying for multiple credit cards or loans within a short period.

- Dispute errors: Review your credit reports regularly and dispute any inaccuracies.

- Monitor your credit: Use free credit monitoring services to stay informed about changes to your credit score.

Retirement Planning: Securing Your Golden Years

Planning for retirement early ensures a secure financial future. Here's how:

- Start saving early: The sooner you start saving, the more time your money has to grow through compound interest.

- Maximize retirement contributions: Contribute as much as possible to employer-sponsored retirement plans, such as 401(k)s or IRAs.

- Explore investment options: Invest your retirement savings in a diversified portfolio of stocks, bonds, and other investments.

- Estimate retirement expenses: Consider your expected lifestyle and healthcare costs in retirement to determine how much you need to save.

- Consult a financial advisor: Seek professional guidance to create a personalized retirement plan.

Financial Literacy: Empowering Yourself

Financial literacy is the foundation for sound financial decision-making. Here's how to improve your financial literacy:

- Read and educate yourself: Access books, articles, and online resources on personal finance and investing.

- Attend workshops and seminars: Participate in educational events on financial planning and money management.

- Seek professional advice: Don't hesitate to consult a financial advisor for personalized guidance and support.

- Experiment with different budgeting and investment strategies: Practice applying financial concepts to develop confidence.

- Stay informed about financial news and events: Monitor financial markets and stay updated on economic trends.

By embracing these life-changing financial tips, you can take control of your finances, secure your financial future, and achieve your financial goals. Remember, financial literacy is an ongoing journey that requires commitment and consistent effort. By empowering yourself with knowledge and implementing these strategies, you can unlock the door to financial freedom and peace of mind.

5 out of 5

| Language | : | English |

| File size | : | 529 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 19 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Garry Goodman

Garry Goodman Cheryl Strayed

Cheryl Strayed Jeffrey Jacob

Jeffrey Jacob Sarah L Schuette

Sarah L Schuette Cheryl Day

Cheryl Day Lorraine Heath

Lorraine Heath Dennis Littky

Dennis Littky Markater C

Markater C Lara Smithe

Lara Smithe Carmen Boullosa

Carmen Boullosa Don Hossler

Don Hossler Lena Little

Lena Little Emeril Lagasse

Emeril Lagasse Jeff Lindsay

Jeff Lindsay Michael Cimicata

Michael Cimicata Malachi Jenkins

Malachi Jenkins H W Brands

H W Brands Lucy Wolfe

Lucy Wolfe Sara Henning

Sara Henning Joseph Roth

Joseph Roth

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jeremy MitchellFollow ·12.9k

Jeremy MitchellFollow ·12.9k Herman MitchellFollow ·15.8k

Herman MitchellFollow ·15.8k Craig CarterFollow ·10.7k

Craig CarterFollow ·10.7k Marcus BellFollow ·18.4k

Marcus BellFollow ·18.4k Isaac MitchellFollow ·13.7k

Isaac MitchellFollow ·13.7k Milton BellFollow ·10.5k

Milton BellFollow ·10.5k Robin PowellFollow ·5.2k

Robin PowellFollow ·5.2k Junichiro TanizakiFollow ·15.5k

Junichiro TanizakiFollow ·15.5k

Caleb Carter

Caleb CarterThe Complete Beagle Dog Beginners Guide: Beagle Facts,...

Beagles are...

Gage Hayes

Gage HayesThe Origins and Evolution of No Child Left Behind:...

The No Child Left Behind...

George Martin

George MartinThe Love Pirates: A Swashbuckling Tale of Love,...

The Love Pirates is a thrilling...

Nathaniel Hawthorne

Nathaniel HawthorneDifferentiating the Curriculum for Gifted Learners:...

Gifted learners are...

Carlos Fuentes

Carlos FuentesThe Years of Rice and Salt: A Journey Through a Forgotten...

The Years of Rice and Salt is...

Herbert Cox

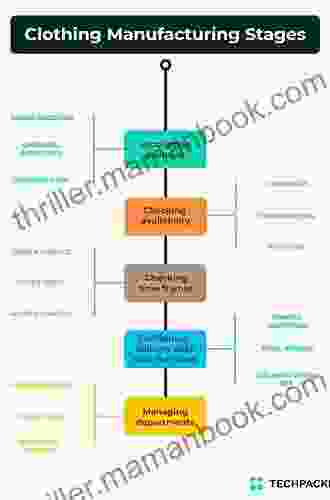

Herbert CoxThe Intricate Design of Clothing Manufacturing Processes:...

The clothing industry is a vast and...

5 out of 5

| Language | : | English |

| File size | : | 529 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 19 pages |

| Lending | : | Enabled |