The Boom and Bust Cycle of Oil Prices: A Historical Perspective and Future Outlook

The global energy landscape has been shaped by the cyclical nature of oil prices. Boom periods characterized by high prices and increased production have been followed by busts marked by low prices and reduced investment. This dynamic has played a pivotal role in shaping economic growth, geopolitical tensions, and the transition to renewable energy.

Historical Context

The First Oil Boom (1859-1873)

The discovery of oil in Pennsylvania in 1859 sparked the first oil boom. As demand for kerosene, a lamp fuel, surged, oil production soared, leading to a period of rapid economic growth and technological innovation. However, overproduction and dwindling reserves triggered a price crash in 1873, marking the end of the first boom.

4.6 out of 5

| Language | : | English |

| File size | : | 1472 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 325 pages |

The Rise of Standard Oil (1870-1911)

John D. Rockefeller's Standard Oil Company emerged as a dominant force in the oil industry during this period. Through strategic acquisitions and vertical integration, Rockefeller gained control of a vast network of refineries, pipelines, and distribution channels. The company's monopoly led to higher prices, but also increased production and technological advancements.

The Texas Oil Boom (1901-1930)

The discovery of massive oil reserves in Texas, particularly at Spindletop in 1901, ushered in another oil boom. The influx of production drove down prices, sparking a period of oversupply and financial instability. The boom ended with the Great Depression, which reduced demand for oil and collapsed prices.

The Post-World War II Boom (1945-1973)

Following World War II, global demand for oil surged as economies recovered and industrialization spread. The Middle East emerged as a major oil producer, and the formation of OPEC (Organization of the Petroleum Exporting Countries) in 1960 gave oil-producing countries greater control over prices.

The 1973 Oil Crisis

The 1973 Arab-Israeli War led to an oil embargo by OPEC against Western countries, triggering a severe price spike. This crisis exposed the vulnerability of global economies to supply disruptions and highlighted the need for alternative energy sources.

The 1979 Oil Crisis

The Iranian Revolution in 1979 further disrupted global oil supplies, resulting in another price spike. The crisis accelerated the development and adoption of renewable energy technologies, such as solar and wind power.

Recent Trends and Future Outlook

The 2008 Financial Crisis

The 2008 financial crisis led to a sharp decline in global oil demand, resulting in a price collapse. The oversupply of oil persisted until the early 2010s, keeping prices low.

The Shale Oil Revolution

The development of new technologies, such as horizontal drilling and hydraulic fracturing, made it possible to extract oil from shale rock formations. This led to a surge in U.S. oil production, making the country the world's largest oil producer by 2018.

The 2020 Oil Price Crash

The COVID-19 pandemic caused a dramatic decline in global oil demand in 2020. The oversupply of oil led to a historic price crash, with some crude grades briefly falling below zero.

Post-Pandemic Recovery

As the global economy recovered from the pandemic, oil demand rebounded, leading to a gradual rise in prices. However, geopolitical tensions, particularly in the Middle East, continue to affect oil market stability.

Factors Driving Boom and Bust Cycles

Global Economic Growth

Economic growth drives oil demand, leading to higher prices during periods of expansion. Conversely, recessions reduce demand, causing prices to fall.

Supply and Demand Imbalances

Overproduction can lead to price declines, while supply disruptions can drive prices higher. Technological advancements and the discovery of new reserves also influence supply and demand dynamics.

Geopolitical Events

Political instability, wars, and embargoes can disrupt oil production and transportation, causing price shocks.

Alternative Energy Sources

The development and adoption of alternative energy sources, such as renewable energy and electric vehicles, can reduce demand for oil, putting downward pressure on prices.

Implications for the Future

Economic Growth

Continued economic growth will drive oil demand and support prices. However, the transition to renewable energy and the adoption of energy efficiency measures may slow demand growth in the long run.

Geopolitical Tensions

Ongoing geopolitical tensions, particularly in oil-producing regions, pose risks to global oil supplies and can lead to price volatility.

Climate Change and Energy Transition

Climate change concerns and the push for decarbonization are driving the transition to renewable energy sources. This transition will gradually reduce oil demand, potentially leading to a long-term decline in prices.

Technology and Innovation

Technological advancements, such as improved drilling techniques and alternative fuel technologies, can influence both oil production costs and the development of non-oil energy sources.

The boom and bust cycle of oil prices has been a defining characteristic of the global energy landscape. While economic growth, supply and demand imbalances, geopolitical events, and alternative energy sources have shaped past cycles, future price trends will be influenced by ongoing economic recovery, geopolitical uncertainties, and the accelerated transition to renewable energy. Understanding these factors is crucial for policymakers, businesses, and investors to navigate the challenges and opportunities presented by the evolving global energy market.

Alt Attribute for Main Image: Historical chart depicting the boom and bust cycles of oil prices from the 19th century to the present. The chart shows periods of high prices and increased production followed by low prices and reduced investment.

4.6 out of 5

| Language | : | English |

| File size | : | 1472 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 325 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Syundei

Syundei Sharan A Gibson

Sharan A Gibson Curtis Thomas

Curtis Thomas Camille Fournier

Camille Fournier Justin Hurwitz

Justin Hurwitz April Hazard Vallerand

April Hazard Vallerand Staci Perry

Staci Perry Arlene J Chai

Arlene J Chai Sandy Carter

Sandy Carter Sean Stevens

Sean Stevens Ronald D Miller

Ronald D Miller Anne Mccaffrey

Anne Mccaffrey R C Majumdar

R C Majumdar Tade Thompson

Tade Thompson Woody Wade

Woody Wade R B Schow

R B Schow Christopher Yost

Christopher Yost Raj Balan S

Raj Balan S Manzur Rashid

Manzur Rashid John Gerard Fagan

John Gerard Fagan

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Gabriel Garcia MarquezFollow ·4.6k

Gabriel Garcia MarquezFollow ·4.6k Stephen FosterFollow ·6.7k

Stephen FosterFollow ·6.7k Giovanni MitchellFollow ·18.6k

Giovanni MitchellFollow ·18.6k Corey GreenFollow ·6k

Corey GreenFollow ·6k Jamie BellFollow ·7.8k

Jamie BellFollow ·7.8k Bruce SnyderFollow ·4.7k

Bruce SnyderFollow ·4.7k Tom HayesFollow ·15.7k

Tom HayesFollow ·15.7k Cameron ReedFollow ·2.7k

Cameron ReedFollow ·2.7k

Caleb Carter

Caleb CarterThe Complete Beagle Dog Beginners Guide: Beagle Facts,...

Beagles are...

Gage Hayes

Gage HayesThe Origins and Evolution of No Child Left Behind:...

The No Child Left Behind...

George Martin

George MartinThe Love Pirates: A Swashbuckling Tale of Love,...

The Love Pirates is a thrilling...

Nathaniel Hawthorne

Nathaniel HawthorneDifferentiating the Curriculum for Gifted Learners:...

Gifted learners are...

Carlos Fuentes

Carlos FuentesThe Years of Rice and Salt: A Journey Through a Forgotten...

The Years of Rice and Salt is...

Herbert Cox

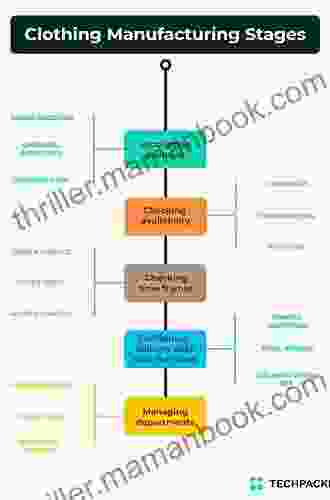

Herbert CoxThe Intricate Design of Clothing Manufacturing Processes:...

The clothing industry is a vast and...

4.6 out of 5

| Language | : | English |

| File size | : | 1472 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 325 pages |