Introduction

Predicting stock returns is a challenging but potentially rewarding task. The ability to accurately forecast future returns can help investors make better investment decisions and achieve higher returns. However, predicting stock returns is not an easy task. There are a number of factors that can affect stock prices, making it difficult to predict their future movements.

In this article, we will discuss the implications of predicting stock returns for asset pricing. We will first review the different methods that can be used to predict stock returns. Then, we will discuss the challenges involved in predicting stock returns. Finally, we will explore the potential implications of predicting stock returns for asset pricing.

There are a number of different methods that can be used to predict stock returns. Some of the most common methods include:

4.7 out of 5

| Language | : | English |

| File size | : | 1101 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 153 pages |

- Fundamental analysis: This method involves analyzing a company's financial statements and other data to assess its financial health and prospects. Fundamental analysts believe that a company's stock price is ultimately determined by its underlying fundamentals.

- Technical analysis: This method involves studying historical stock price data to identify patterns and trends. Technical analysts believe that these patterns can be used to predict future stock price movements.

- Quantitative analysis: This method involves using mathematical and statistical models to predict stock returns. Quantitative analysts believe that these models can be used to capture the relationships between different factors and stock returns.

There are a number of challenges involved in predicting stock returns. Some of the most common challenges include:

- Data availability: The data that is available to predict stock returns is often limited and noisy. This can make it difficult to build accurate and reliable models.

- Unpredictability of markets: Stock markets are inherently unpredictable. This means that even the most sophisticated models can only make probabilistic predictions about future returns.

- Behavioral biases: Investors often make irrational investment decisions based on their emotions. This can make it difficult to predict how the market will react to new information.

Predicting stock returns has a number of potential implications for asset pricing. Some of the most important implications include:

- Pricing efficiency: If investors are able to accurately predict stock returns, the market will become more efficient. This will reduce the risk premium that investors require for holding risky assets.

- Investment strategies: The ability to predict stock returns can help investors develop more effective investment strategies. For example, investors may be able to use their predictions to identify undervalued stocks or to time their investments.

- Risk management: Predicting stock returns can help investors manage risk. For example, investors may be able to use their predictions to hedge against potential losses or to reduce their overall portfolio risk.

Predicting stock returns is a challenging but potentially rewarding task. The ability to accurately forecast future returns can help investors make better investment decisions and achieve higher returns. However, predicting stock returns is not an easy task. There are a number of factors that can affect stock prices, making it difficult to predict their future movements.

In this article, we have discussed the implications of predicting stock returns for asset pricing. We have reviewed the different methods that can be used to predict stock returns, the challenges involved in predicting stock returns, and the potential implications of predicting stock returns for asset pricing.

We believe that predicting stock returns is a valuable tool for investors. However, it is important to remember that predicting stock returns is not an exact science. There are no guarantees that any particular method will be able to accurately predict future returns. Investors should always use caution when making investment decisions and should diversify their portfolios to reduce risk.

4.7 out of 5

| Language | : | English |

| File size | : | 1101 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 153 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Matthew Campbell

Matthew Campbell Ruth King

Ruth King Barby Keel

Barby Keel Martha C Nussbaum

Martha C Nussbaum April Hazard Vallerand

April Hazard Vallerand Malachi Jenkins

Malachi Jenkins Lucy Wolfe

Lucy Wolfe Kylie Walker

Kylie Walker Pat Mills

Pat Mills Robin Roughley

Robin Roughley Clay Risen

Clay Risen Michael Arkush

Michael Arkush Without Warrant

Without Warrant Lorraine Heath

Lorraine Heath Kim Stanley Robinson

Kim Stanley Robinson Markus Ray

Markus Ray G A Henty

G A Henty Lakota Grace

Lakota Grace Woody Wade

Woody Wade Wayne Stinnett

Wayne Stinnett

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Federico García LorcaTrap Kitchen Malachi Jenkins: From Humble Beginnings to a Culinary Empire

Federico García LorcaTrap Kitchen Malachi Jenkins: From Humble Beginnings to a Culinary Empire Tom ClancyFollow ·13.6k

Tom ClancyFollow ·13.6k Blake BellFollow ·11.9k

Blake BellFollow ·11.9k Devin CoxFollow ·14.3k

Devin CoxFollow ·14.3k Arthur MasonFollow ·6k

Arthur MasonFollow ·6k Andrew BellFollow ·11.4k

Andrew BellFollow ·11.4k Jordan BlairFollow ·5.2k

Jordan BlairFollow ·5.2k Aubrey BlairFollow ·7.2k

Aubrey BlairFollow ·7.2k Michael ChabonFollow ·14.6k

Michael ChabonFollow ·14.6k

Caleb Carter

Caleb CarterThe Complete Beagle Dog Beginners Guide: Beagle Facts,...

Beagles are...

Gage Hayes

Gage HayesThe Origins and Evolution of No Child Left Behind:...

The No Child Left Behind...

George Martin

George MartinThe Love Pirates: A Swashbuckling Tale of Love,...

The Love Pirates is a thrilling...

Nathaniel Hawthorne

Nathaniel HawthorneDifferentiating the Curriculum for Gifted Learners:...

Gifted learners are...

Carlos Fuentes

Carlos FuentesThe Years of Rice and Salt: A Journey Through a Forgotten...

The Years of Rice and Salt is...

Herbert Cox

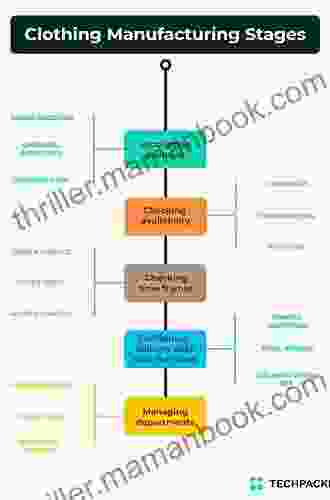

Herbert CoxThe Intricate Design of Clothing Manufacturing Processes:...

The clothing industry is a vast and...

4.7 out of 5

| Language | : | English |

| File size | : | 1101 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 153 pages |