How the World Elite Money Managers Lead and Invest: A Comprehensive Guide

The world's elite money managers are a select group of individuals who oversee trillions of dollars in assets and consistently generate superior returns for their clients. They are the architects of the global financial system, and their decisions can have a profound impact on the wealth and well-being of nations.

In this article, we will take an in-depth look at how the world elite money managers lead and invest. We will examine their investment strategies, risk management techniques, and leadership principles. By understanding their approach to investing, we can gain valuable insights that can help us improve our own investment portfolios.

The investment strategies of the world elite money managers vary widely depending on their individual risk tolerance and investment objectives. However, there are some common themes that run through their approach to investing:

4.1 out of 5

| Language | : | English |

| File size | : | 680 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 233 pages |

- Long-term focus: Elite money managers invest for the long term. They believe that the best way to generate superior returns is to invest in businesses with strong fundamentals and staying power.

- Diversification: Elite money managers diversify their portfolios both across asset classes (e.g., stocks, bonds, real estate) and within asset classes (e.g., different sectors, industries, and countries). This helps to reduce risk and improve the overall performance of the portfolio.

- Value investing: Elite money managers often use a value investing approach. This involves investing in undervalued companies that have the potential to generate strong returns over time.

- Growth investing: Elite money managers also invest in growth companies. These are companies that are expected to experience above-average earnings growth.

- Alternative investments: Elite money managers frequently invest in alternative investments, such as private equity, hedge funds, and venture capital. These investments can generate higher returns but also come with higher risks.

Risk management is a critical aspect of investment management. The world elite money managers understand that risk is inherent in investing, and they take a number of steps to manage risk in their portfolios:

- Asset allocation: Elite money managers use asset allocation to diversify their portfolios and reduce risk. They determine the optimal mix of asset classes based on their risk tolerance and investment objectives.

- Risk limits: Elite money managers set risk limits for their portfolios. These limits are designed to prevent them from taking on too much risk.

- Stress testing: Elite money managers stress test their portfolios to see how they would perform in different market conditions. This helps them to identify and mitigate potential risks.

- Hedging: Elite money managers use hedging strategies to reduce the risk of losses in their portfolios. Hedging involves taking a position that is opposite to the position they have in the underlying asset.

The world elite money managers are not only skilled investors but also effective leaders. They possess a number of key leadership principles that help them achieve success:

- Vision: Elite money managers have a clear vision for their firms and their portfolios. They communicate this vision to their teams and clients, and they inspire others to follow them.

- Decision-making: Elite money managers are decisive. They gather information, weigh the pros and cons, and make decisions quickly. They are not afraid to take risks, but they also calculate risks carefully.

- Communication: Elite money managers are effective communicators. They explain their investment strategies to clients in a clear and concise manner. They also listen to client feedback and take it into account in their decision-making.

- Teamwork: Elite money managers build strong teams. They surround themselves with talented people who share their vision and values. They empower their teams to make decisions and take ownership of their work.

- Integrity: Elite money managers are ethical and trustworthy. They manage their clients' money with the utmost care and integrity.

The world elite money managers are masters of their craft. They have developed a deep understanding of financial markets and are able to generate superior returns for their clients through a combination of investment strategies, risk management techniques, and leadership principles. By understanding their approach to investing, we can gain valuable insights that can help us improve our own investment portfolios and achieve financial success.

4.1 out of 5

| Language | : | English |

| File size | : | 680 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 233 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Brian Wolfe

Brian Wolfe Neetha Naidu

Neetha Naidu Robin Van Auken

Robin Van Auken Michel Houellebecq

Michel Houellebecq Michael Cimicata

Michael Cimicata David Isaac Yoder

David Isaac Yoder Becci Murray

Becci Murray Jim Cobb

Jim Cobb R B Schow

R B Schow L Christopher Hennessy

L Christopher Hennessy Ronald D Miller

Ronald D Miller Bill O Reilly

Bill O Reilly Cadfolks

Cadfolks E H De La Espriella

E H De La Espriella Staci Perry

Staci Perry E Nesbit

E Nesbit Chuck Hemann

Chuck Hemann Penelope Sky

Penelope Sky B E Baker

B E Baker R H Sin

R H Sin

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Norman Butler111 Things About Being a Lightworker: A Comprehensive Guide to Embracing Your...

Norman Butler111 Things About Being a Lightworker: A Comprehensive Guide to Embracing Your...

Charles BukowskiUnveiling The Baby Sleep Solution: A Comprehensive Guide to Restful Nights...

Charles BukowskiUnveiling The Baby Sleep Solution: A Comprehensive Guide to Restful Nights...

Allen ParkerThis Burning Maria Rae: A Haunting and Unforgettable Tale of Love, Loss, and...

Allen ParkerThis Burning Maria Rae: A Haunting and Unforgettable Tale of Love, Loss, and... Cristian CoxFollow ·4.3k

Cristian CoxFollow ·4.3k Dean ButlerFollow ·8.1k

Dean ButlerFollow ·8.1k Albert CamusFollow ·18.7k

Albert CamusFollow ·18.7k Albert ReedFollow ·12k

Albert ReedFollow ·12k George Bernard ShawFollow ·8.4k

George Bernard ShawFollow ·8.4k Glenn HayesFollow ·17k

Glenn HayesFollow ·17k Emmett MitchellFollow ·10.2k

Emmett MitchellFollow ·10.2k David PetersonFollow ·2.8k

David PetersonFollow ·2.8k

Caleb Carter

Caleb CarterThe Complete Beagle Dog Beginners Guide: Beagle Facts,...

Beagles are...

Gage Hayes

Gage HayesThe Origins and Evolution of No Child Left Behind:...

The No Child Left Behind...

George Martin

George MartinThe Love Pirates: A Swashbuckling Tale of Love,...

The Love Pirates is a thrilling...

Nathaniel Hawthorne

Nathaniel HawthorneDifferentiating the Curriculum for Gifted Learners:...

Gifted learners are...

Carlos Fuentes

Carlos FuentesThe Years of Rice and Salt: A Journey Through a Forgotten...

The Years of Rice and Salt is...

Herbert Cox

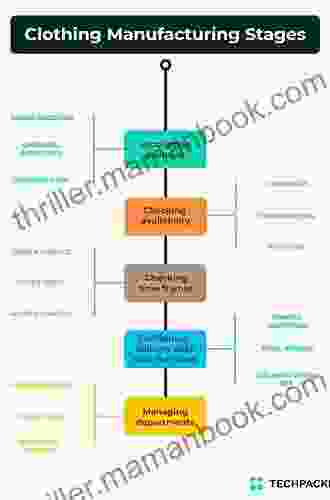

Herbert CoxThe Intricate Design of Clothing Manufacturing Processes:...

The clothing industry is a vast and...

4.1 out of 5

| Language | : | English |

| File size | : | 680 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 233 pages |